|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Pet Health Insurance in Maryland: A Comprehensive GuideWhy Consider Pet Health Insurance?Pet health insurance in Maryland can provide peace of mind for pet owners. With rising veterinary costs, having insurance can help manage expenses and ensure your furry friend gets the care they need. Benefits of Pet Health Insurance

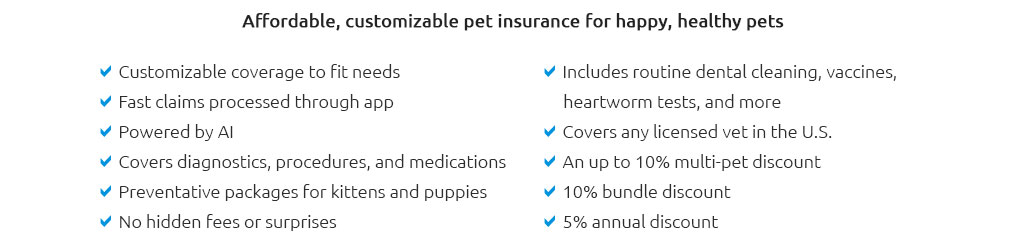

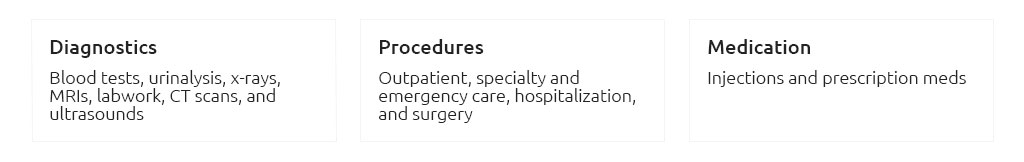

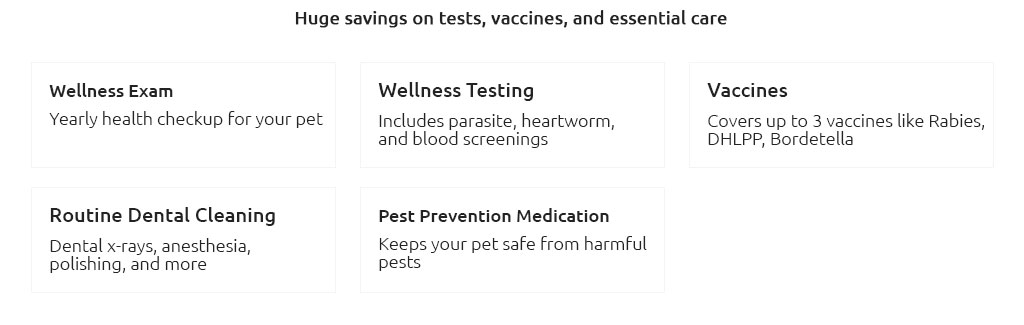

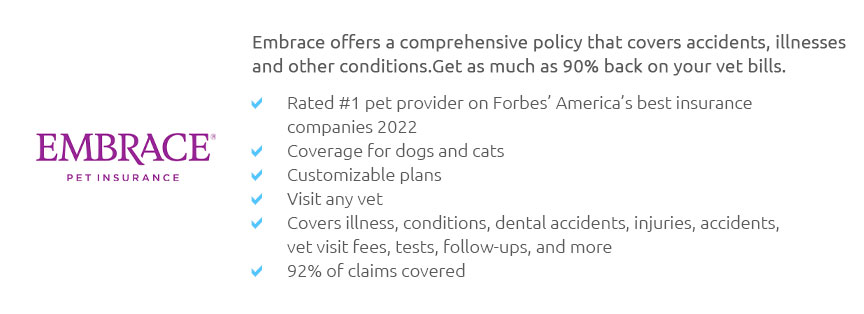

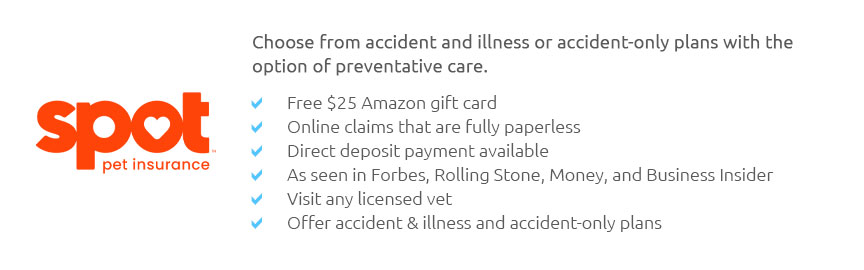

Types of Coverage AvailableIn Maryland, pet insurance policies vary, offering different levels of coverage to suit various needs. Accident-Only PlansThese plans cover injuries resulting from accidents, like fractures or swallowed objects. Comprehensive PlansComprehensive plans offer broader coverage, including accidents, illnesses, and sometimes wellness care. For more extensive options, explore pet insurance nys. Choosing the Right PlanWhen selecting a pet insurance plan, consider your pet's age, breed, and health status. Factors to Consider

Real-World ExamplesMany Maryland pet owners have shared success stories of how insurance saved them from financial strain. One such owner said, 'Without insurance, we couldn't have afforded the surgery our dog needed.' For more about different plans, you can check out various pet insurance offers available online. Frequently Asked Questions

https://www.insurancebusinessmag.com/us/news/breaking-news/maryland-sets-new-rules-for-pet-insurance-coverage-and-disclosures-517470.aspx

The Maryland Insurance Administration has outlined new regulations and notification requirements for insurers offering pet insurance. https://paradiseanimalhospital.com/services/pet-care/pet-health-insurance/

Paradise Animal Hospital in Catonsville, MD Pet Insurance Center - Offering financial support for the cost of any vet bills - Allowing you to get the best ... https://insurance.maryland.gov/Consumer/Documents/publicnew/WhatIsPetInsurance-ConsumerAdvisory.pdf

insurance.maryland.gov. Pet insurance is not health insurance for your pet, although at times, it sure sounds like it is. While most of us consider our pets ...

|